Loss of Income Insurance

One of the best ways to protect your Chula Vista business is with a comprehensive loss of business income insurance policy – just like what we offer here at Hoffman Hanono. Think of this type of commercial insurance as a backup plan for emergencies. When you experience a covered loss, you'll have peace of mind knowing you'll get assistance with payroll, taxes, and replacing net losses you accrue. Ensure your business has stability and reduce the stress of a loss of income by contacting our San Diego commercial insurance agency today.

What It Covers

Also known as business interruption insurance, loss of income insurance covers a wide range of things, depending on the covered losses in the policy. Loss of earnings insurance can be tacked onto a commercial policy, business owner's policy, or can be a standalone one, and typically covers:

- Loss of income due to a temporary, unforeseen disruption (like a storm that shuts down business or being the victim of an online hacker)

- A portion of mortgage or rent payments

- Employee wages and payroll

- Loan payments

- Tax payments

Custom Solutions

Our Income Protection Insurance Approach

End your search for income insurance protection in San Diego by turning to our Hoffman Hanono team. We're here to advise and partner with you to ensure you get the right coverage for your Chula Vista or Southern California-area business. We specialize in finding insurance solutions meant entirely for you—because we know that insurance is not "one-size-fits-all." We provide quality service and resources that will help you secure better insurance premiums in the long run. Our commitment has made us a pillar of the San Diego insurance community since 1959.

Trusted & Time-Tested Solutions

50+ Years Experience

Serving San Diego since 1959. We’re still family-owned and customer-focused.

All Lines of Insurance

We provide you with the most comprehensive coverage at a competitive cost.

Quality Service

We are dedicated to bringing you reliable and top-notch customer service.

Loss of Income Insurance FAQs

1. What is loss of income insurance?

Loss of income insurance, also known as business interruption insurance, is a type of coverage designed to help businesses recover financially after an unforeseen disruption. It acts as a backup plan, assisting with payroll, taxes, and replacing net losses your business may incur during a covered event.

2. Who needs loss of income insurance in San Diego and Chula Vista?

Any business owner in Chula Vista, San Diego, or the surrounding areas should consider loss of income insurance. Whether you run a small shop or a larger enterprise, this coverage ensures business stability and helps reduce the stress caused by unexpected income interruptions.

3. What does loss of income insurance cover?

Loss of income insurance typically covers loss of earnings due to temporary, unforeseen disruptions such as natural disasters, storms, or cyberattacks. It can also cover a portion of mortgage or rent payments, employee wages and payroll, loan payments, and tax obligations. Policies can be added to commercial policies, business owner’s policies, or purchased as standalone coverage.

4. How does Hoffman Hanono approach loss of income insurance?

At Hoffman Hanono, we provide personalized guidance to ensure your business gets the right coverage. We evaluate your business needs, partner with trusted insurance providers, and customize your policy to protect your assets. Our team focuses on long-term value, helping secure competitive premiums and comprehensive coverage tailored for your business.

5. Why choose Hoffman Hanono for loss of income insurance in San Diego?

With over 50 years of experience serving the San Diego and Chula Vista communities, Hoffman Hanono is a family-owned, customer-focused agency. Our expertise, personalized approach, and commitment to reliable service make us a trusted partner in protecting your business’s financial stability.

6. How can I get a quote for loss of income insurance?

You can request a quote online, call our office, or email our team. Hoffman Hanono’s agents will guide you through the options and ensure your business gets the right coverage to maintain stability and peace of mind.

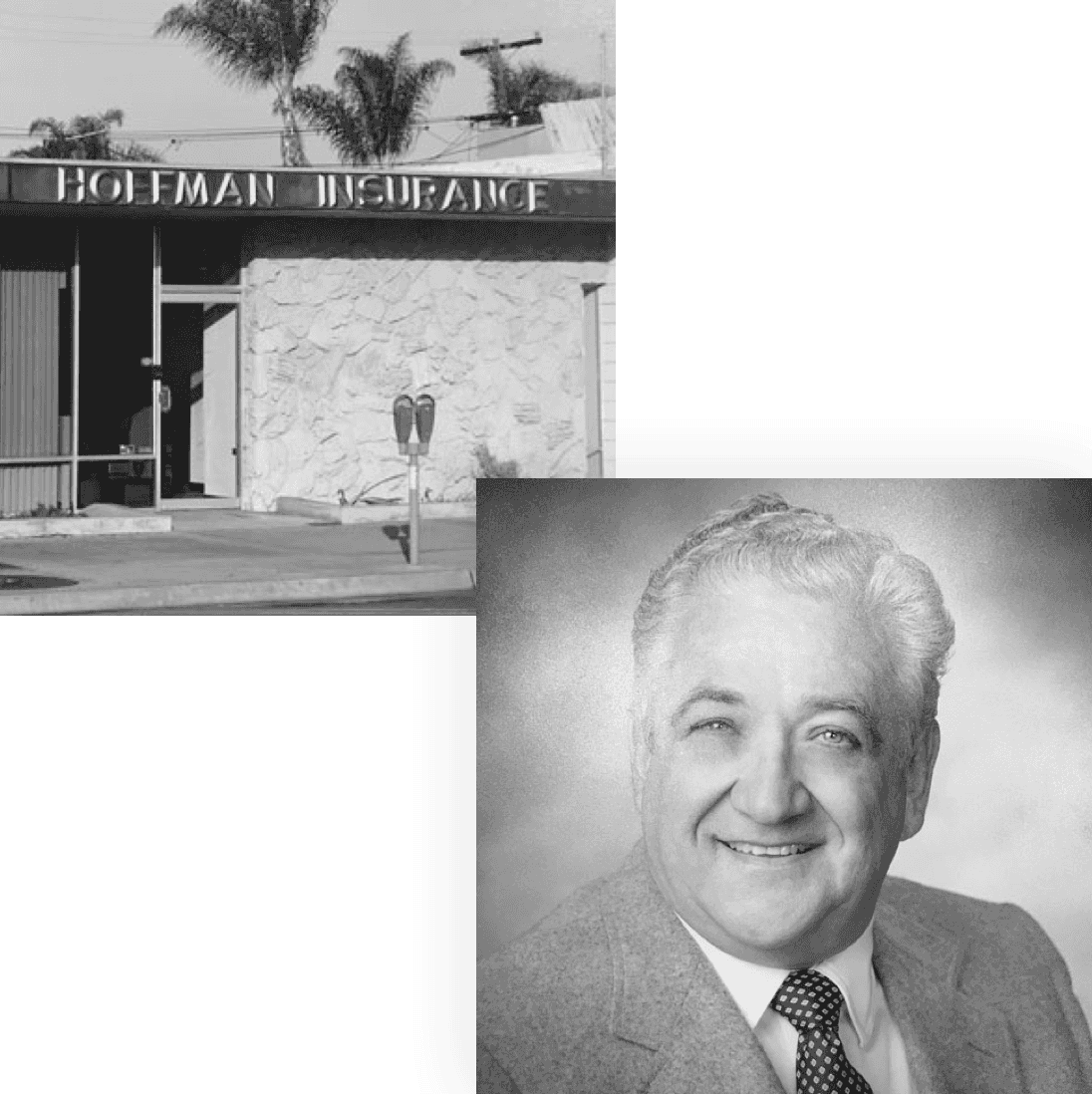

First-Class Service Since 1959

The story of our commercial insurance company starts with founder Jerry Hoffman, who aimed to offer cost-effective insurance solutions, superior customer service, and ultimately, peace of mind. Since then, the company has been passed down generations without losing our founder’s commitment.

Learn MorePeace of mind is priceless.

Let us help you get the right coverage for the right price.

Get a quote today!